The concept of levying sales tax on commercial rent can be a surprise to many, especially if they are not familiar with the few jurisdictions where this practice exists. Unlike tangible goods, services like leasing commercial real estate are not always subject to sales tax. However, there are exceptions.

Why Sales Tax on Commercial Rent?

Sales tax is traditionally applied to the sale of tangible personal property. However, some states and cities have expanded their sales tax base to include certain services, including commercial rent, as a way to generate additional revenue.

How is the Sales Tax Paid?

The tax is typically paid by the landlord. The tax is then passed through to the tenant, who pays the landlord directly. This can be different depending on the terms of the lease.

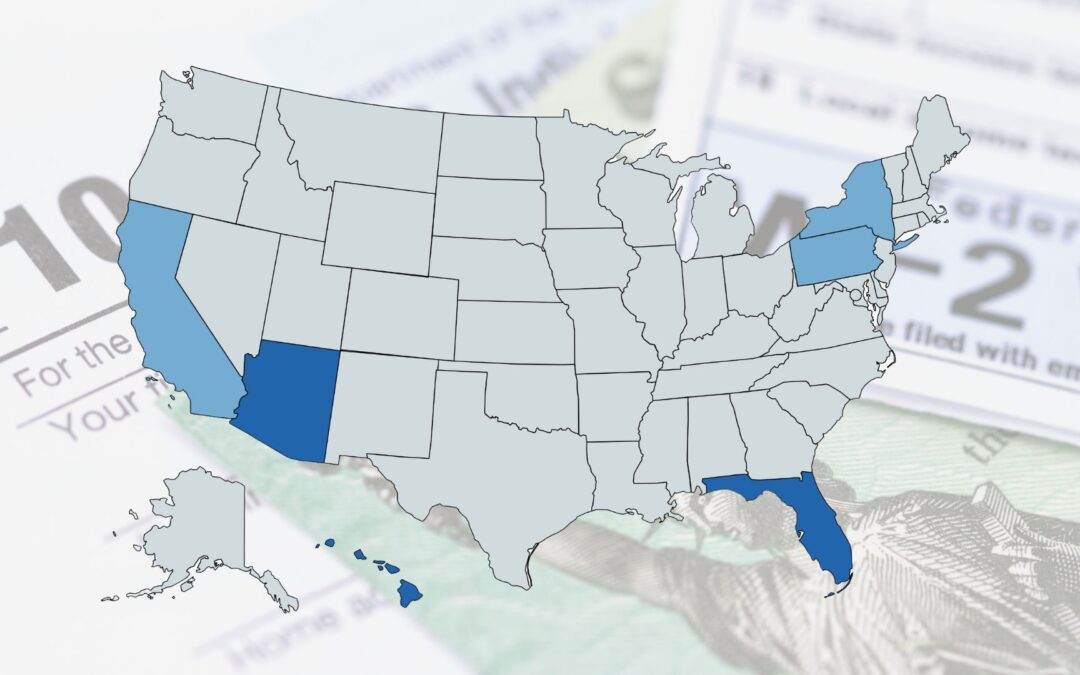

States Charging Sales Tax on Commercial Rent:

Florida

One of the most notable states that charge sales tax on commercial rent is Florida. The Sunshine State imposes a sales tax on the total rent charged for renting, leasing, letting, or granting a license to use commercial real estate. This tax is applied unless the property is specifically exempt. Florida recently decreased the commercial sales tax. As of December 2023, the state tax rate is 4.5%. Beginning in June 2024, the state tax rate will be reduced to 2.0%. In addition to the state tax rate, Florida counties tax an additional 0-1.5%.

Arizona

Arizona does not have a state on commercial rent, however most cities and counties do. As of September 2023, Phoenix’s tax rate is 2.4%; the combined rate (including Maricopa county tax) is 2.9%. Surrounding cities in Maricopa county charge a commercial rent tax in the same ballpark: Chandler’s city commercial tax rate is 1.5%, Scottsdale is 1.75%, Mesa is 2% and Glendale is 2.9%. Further south, Tucson’s city commercial tax rate is 2.6%; the combined rate (including Pima county tax) is 3.1%

Hawaii

Hawaii charges a general excise tax on commercial rent. As of September 2023, the tax rate is 4.166.

Cities Charging Sales Tax on Commercial Rent:

Certain cities in other states have chosen to impose a sales tax on commercial rents. Below is a non-exhaustive list of larger cities that have a tax.

San Francisco, California:

San Francisco passed Proposition C in 2018 to begin a Commercial Sales Tax in 2021. The San Francisco commercial rent tax is 3.5%.

New York City, New York:

While New York State doesn’t impose sales tax on commercial rents, New York City has a Commercial Rent Tax (CRT) that affects commercial tenants in specific areas of Manhattan. The CRT isn’t a sales tax in the traditional sense, but it’s another example of a city-specific tax on commercial rent. As of September 2023, the tax rate is 3.9% after reductions.

Philadelphia, Pennsylvania

Philadelphia also does not impose a direct sales tax on commercial rents. However, it does has a Use & Occupancy tax (U&O Tax) that is an additional tax on top of real property taxes. As of September 2023, the U&O tax rate is 1.21% of the assessed property value.

Should You Be Concerned?

If you’re a business owner or commercial property owner, it’s essential to know the tax landscape of your state and city. Here are a few reasons:

- Budgeting: If you’re a tenant, understanding whether you have to pay sales tax on top of your rent can impact your operational budget.

- Compliance: For landlords, knowing if and how much sales tax to charge and remit is crucial for compliance.

- Location Decisions: If you’re deciding where to locate a business or buy commercial real estate, understanding the full scope of potential taxes can influence your decisions.

While sales tax on commercial rent is not widespread, it does exist in specific jurisdictions. This unique tax setup can significantly impact both tenants and landlords. Tax rates are constantly changing and the above should be used for informational purposes only. Always consult with a tax professional or lease administration expert to understand the nuances of your specific situation and jurisdiction.

Managing a Large Real Estate Portfolio and Sales Taxes

For companies with a large real estate portfolio, managing the implications of tax changes on multiple leases can be complex and time-consuming. This is where lease administration companies can play a crucial role in ensuring that businesses not only comply with new tax laws but also capitalize on potential savings. A lease administration company can assist businesses manage commercial rent sales taxes by monitoring the dynamic tax environment, scheduling the rates, and ensure landlords are charging the correct sales tax rate.